SME SECURED LOANS

Your Gateway to Business Growth

Taking your business

to the next level

At SME Micro Capital, we understand the importance of capital for business owners. That’s why we offer a unique service that allows you to unlock the value of your residential, commercial, or industrial property and channel the additional cash flow directly into your business. Our property loans are designed to provide business owners with quick access to substantial working capital at an affordable rate. Let us help you take your business to new heights.

Key Benefits

Interest Servicing Payment Structure

With our property loans, you'll benefit from an interest servicing payment structure. This means you only need to cover the interest payments on your loan, allowing you to allocate your funds strategically and manage your cash flow more effectively.

Flexible Short-term

Commitment

We understand that business needs can change rapidly, which is why our property loans come with a flexible short-term commitment. You have the freedom to tailor the loan duration to your specific requirements, ensuring that you can meet your business goals without being tied down by long-term obligations.

High Loan-to-Value(LTV)

Our property loans offer a high loan-to-value ratio, providing you with access to a significant portion of your property's value. With an LTV of up to 80%, you can unlock substantial working capital that can be utilized to fuel business growth, invest in new opportunities, or bridge financial gaps.

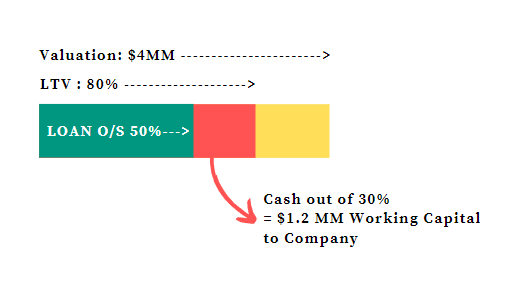

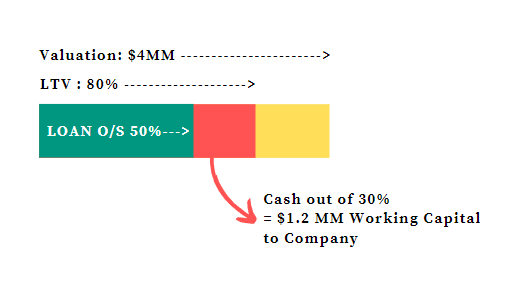

Unlocking Asset Value - Case Study

How's does SME Secured Loans work?

Let’s take a closer look at how SME Micro Capital can help you unlock the value of your property and boost your business.

Imagine you own a residential property valued at $4 million. With an LTV of 80%, you could access $3.2 million of the property’s value.

If you have an outstanding mortgage of $2 million (50%), our loan can help you pay off that mortgage. The remaining $1.2 million (30%) will be paid out to your borrowing company, providing you with a substantial working capital injection.

Key points

- Valuation: $4MM

- LTV: 80%

- Loan Outstanding: 50% ➔ $2MM

- Cash Out: 30% ➔ $1MM working capital to Company

Take the next step

Are you ready to unlock the potential of your property and give your business the boost it deserves? Contact SME Micro Capital today to discuss your specific needs and explore the possibilities together.

Our team of experienced professionals is here to guide you through the process and ensure a seamless and efficient experience. Let’s work together to fuel your business growth.

Remember, at SME Micro Capital , we don’t just offer loans; we offer opportunities.

Do you have a question and require assistance?

Our purpose is to provide assistance. If you have any uncertainties regarding the types of business loans your company qualifies for, please complete the brief form below, and we will contact you promptly.

Thank you!

We will contact you soon. Have a great week ahead.